De Bonis Non Malaysia

The copy inland revenue affidavit as certified by the revenue commissioners to be lodged.

De bonis non malaysia. Find more information at. When an executor or administrator has been appointed and the estate is not fully settled and the executor or administrator is dead has absconded or from any cause has been removed a second administrator is appointed to to. Shopee malaysia is a leading online shopping site based in malaysia that brings you great deals with platforms existing across asia including singapore thailand indonesia vietnam philippines and taiwan. Slots 488 roulette 469 blackjack 461 sports betting 59 video poker 445 bingo 283 baccarat 419 jackpot games 230 live games 210 poker 114 craps 262 keno 324 scratch cards 312 esports betting 28.

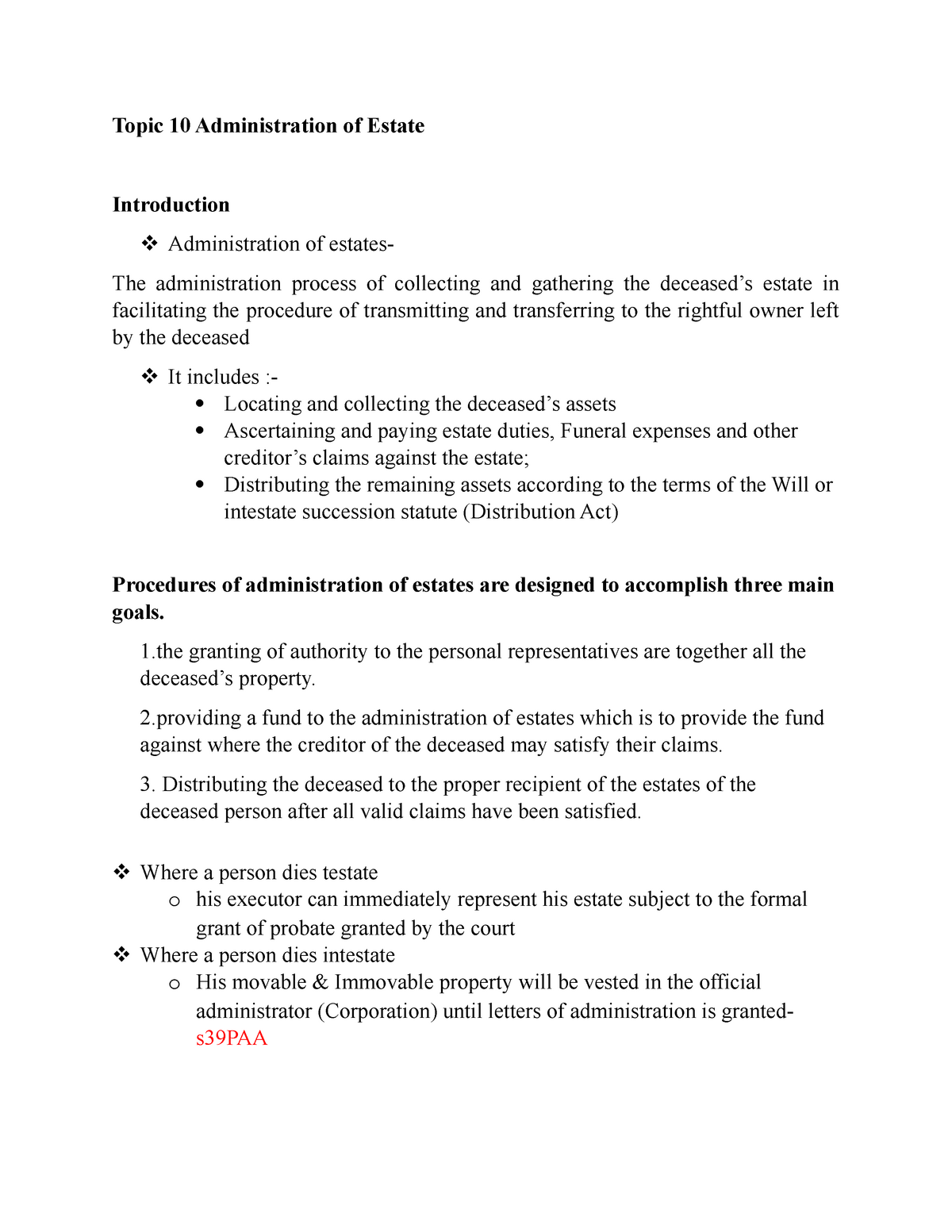

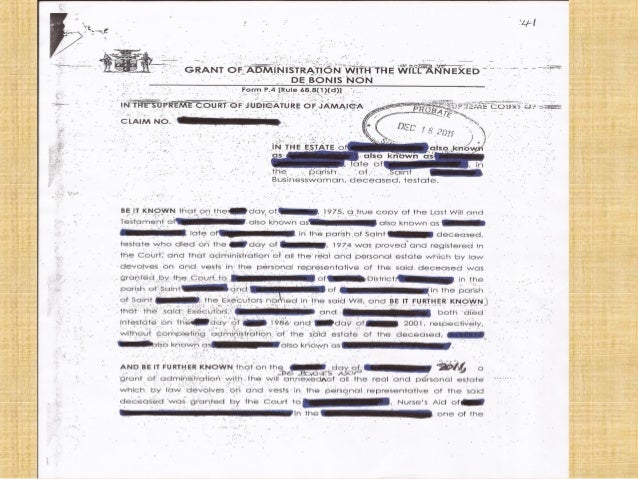

Get free legal quotation from our lawyer on your probate letter of administration or property real estate matter today or call us up for free legal consultation today. Slots roulette blackjack sports betting video poker. De bonis non administratis latin for of goods not administered is a legal term for assets remaining in an estate after the death or removal of the estate administrator the second administrator is called the administrator de bonis non and distributes the remaining assets. B surat kuasa mentadbir debonis non bagi kes kes di mana seseorang yang telah diberi surat kuasa mentadbir meninggal dunia sebelum harta pusaka simati dapat ditadbir c surat kuasa mentadbir oleh perbadanan amanah bagi permohonan yang dibuat oleh syarikat syarikat amanah.

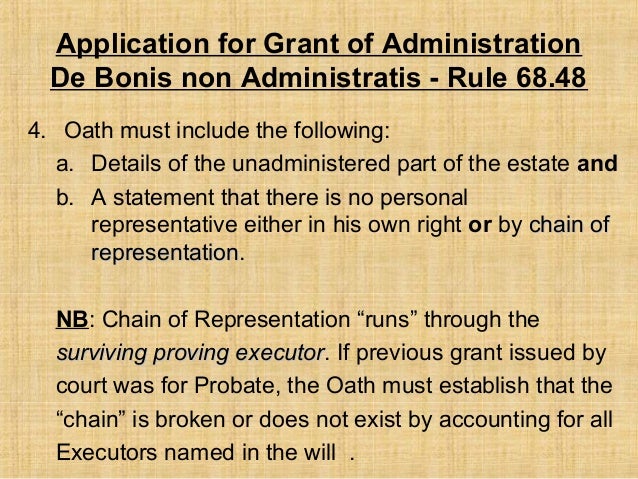

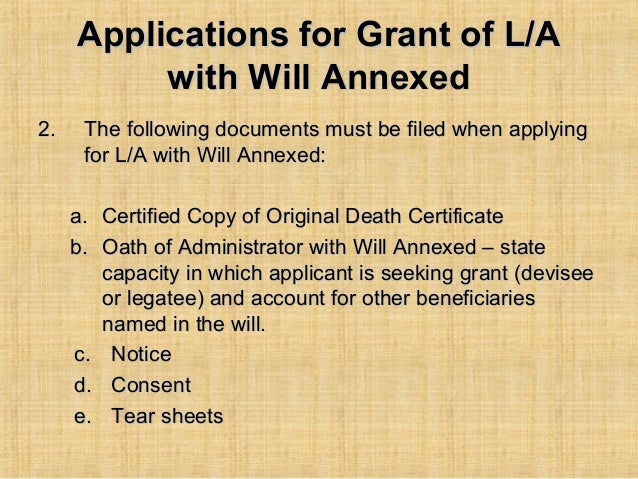

Letters of administration de bonis non in the event probate or letter of administration has been extracted but the executor or administrator died absconded or is incapacitated prior to completion of the administration the person next entitled to the grant of representation can apply to the court for such letter of administration de bonis non in order to finalise the administration of the estate. Ireland malaysia new zealand singapore united kingdom. Please note that the current market value of the estate must be used throughout. A de bonis non grant is appropriate where the personal representative is alive when the primary grant issues but subsequently dies.

It s not something many of us have to think about until the time comes and the industry is filled with legal terms that most of us have never heard of. What is a grant de bonis non and why executors must have a will when it comes to dealing with wills and inheritance it can all appear very confusing. There is a special inland revenue affidavit for de bonis non grants. We offer unbeatable deals featuring an endless range of products priced at affordable rates.

This phrase is used in cases where the goods of a deceased person have not all been administered. In the uniform probate code these titles have been replaced by successor personal representative.