Difference Between Insurance And Takaful In Urdu

Always wondered what is the difference between takaful and life insurance.

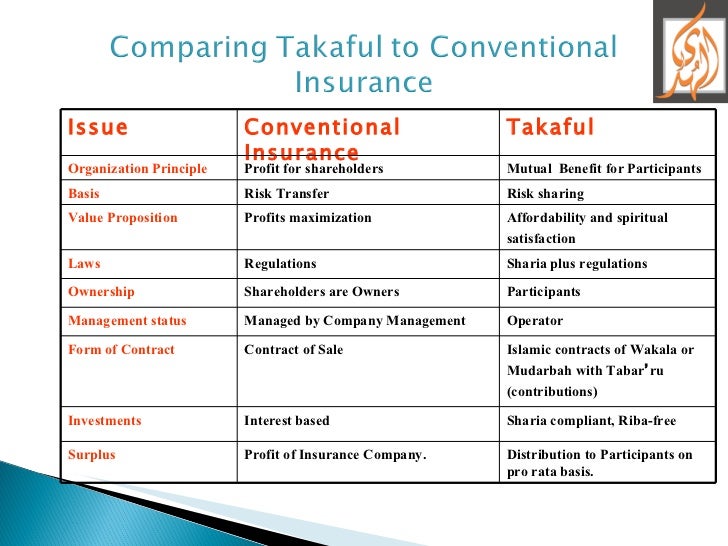

Difference between insurance and takaful in urdu. If you are looking for insurance plans whether conventional or takaful based do have a gander at our comparison page first to discover the most affordable plans with the best terms. Conventional insurance 1 it is a risk transfer mechanism whereby risk is transferred from the policy holder the insured to the insurance company the insurer in consideration of insurance premium paid by the insured. There are differences between islamic and conventional insurance. Conventional insurance difference between takaful and insurance gharar halal haram islamic finance islamic insurance takaful published by rakaan kayali someone trying to look beyond capitalism who is strongly influenced by his muslim faith in his search for solutions.

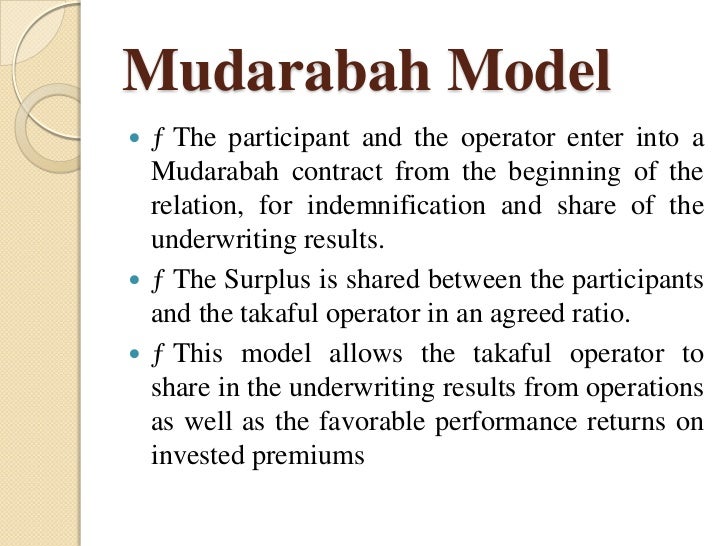

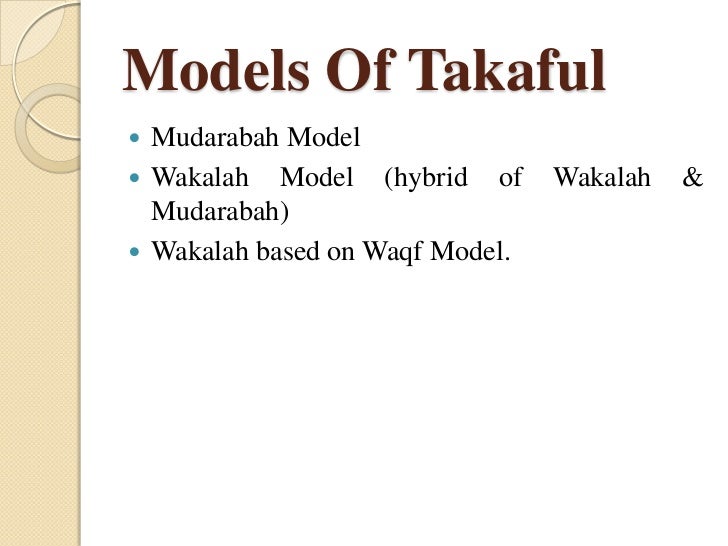

This is the basic plan that meets legal motor insurance takaful requirements under the motor vehicles act 1939. Premiums and contributions for both conventional and takaful policies can be claimed for tax relief for medical life and child education policies. Central ideas and general principle islamic insurance is operation based on al mudharabah financing which is interest free while in conventional insurance it is based on the principle. Although both offers the same purpose which is to protect the insurer there are some major differences between both.

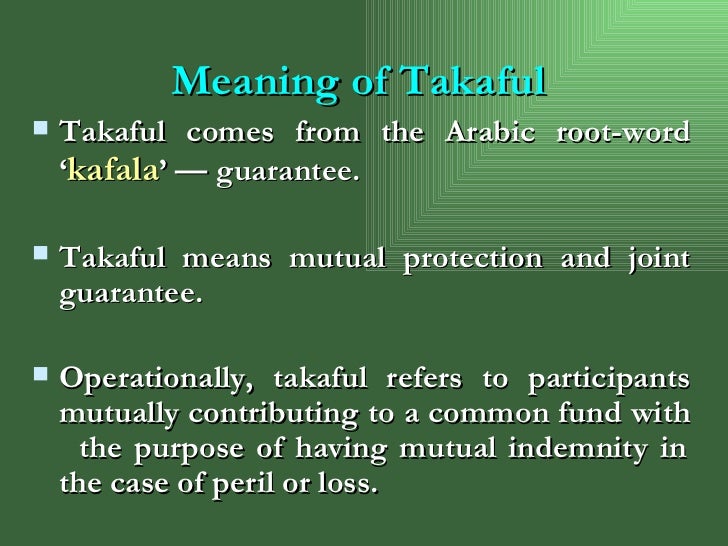

The difference between the first two options is one of degree. In arabic takaful means guaranteeing each other and so takaful insurance is an islamic insurance theory that is compliant with islamic law sharia and is a mutual risk transfer arrangement which involves operators. The key difference between takaful and conventional insurance rests in the way the risk is assessed and handled as well as how the takaful fund is managed. Gharrar which is forbidden in islam.

Takaful is an alternative insurance solution designed to meet shariah principles. The operating guidelines are grounded in islamic muamalat islamic transactions products. Takaful is a type of islamic insurance wherein members contribute money into a pool system to guarantee each other against loss or. Takaful vs insurance ii difference between insurance and takaful.

This difference can be analyzed under central ideas and general principles external factors essential components and contractual factors. Takaful is another name of islamic insurance that allows the premiums received from insured to be pooled into a fund to support each other in case someone gets any damage. Conventional insurance involves the elements of excessive uncertainty gharar in the contract of insurance. Takaful is a relatively new insurance product that is marketed as an islamic alternative to conventional insurance and is often referred to as islamic insurance.