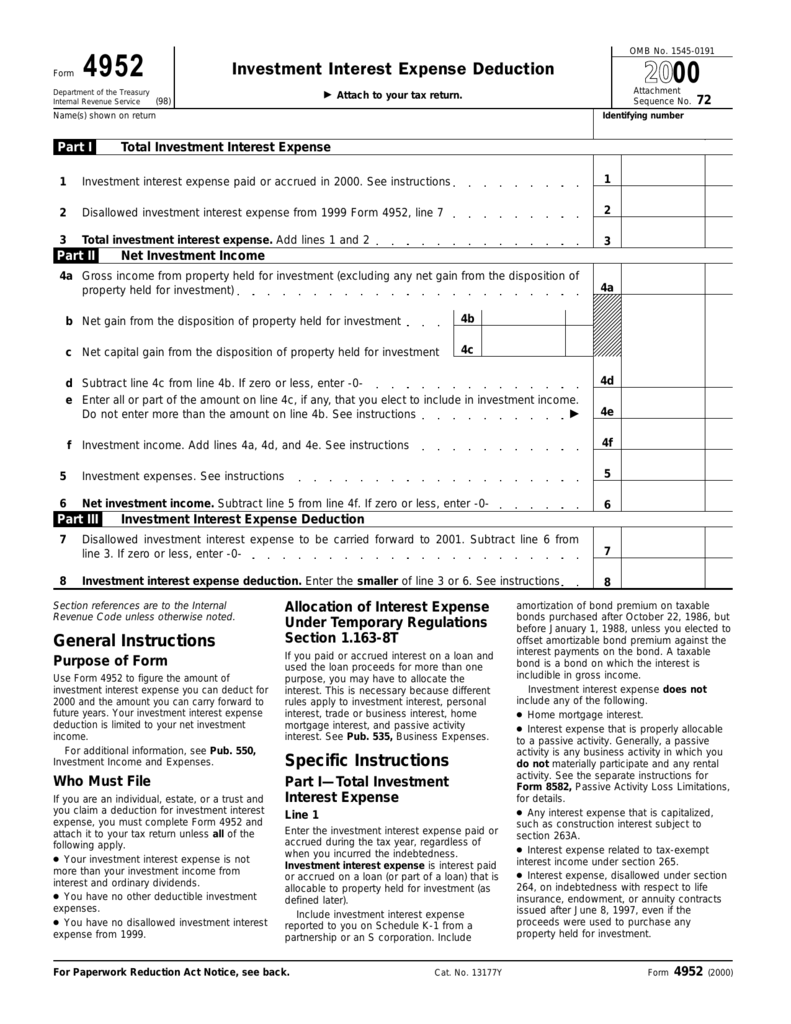

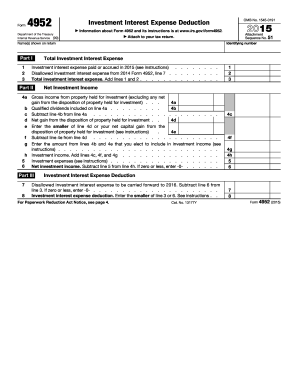

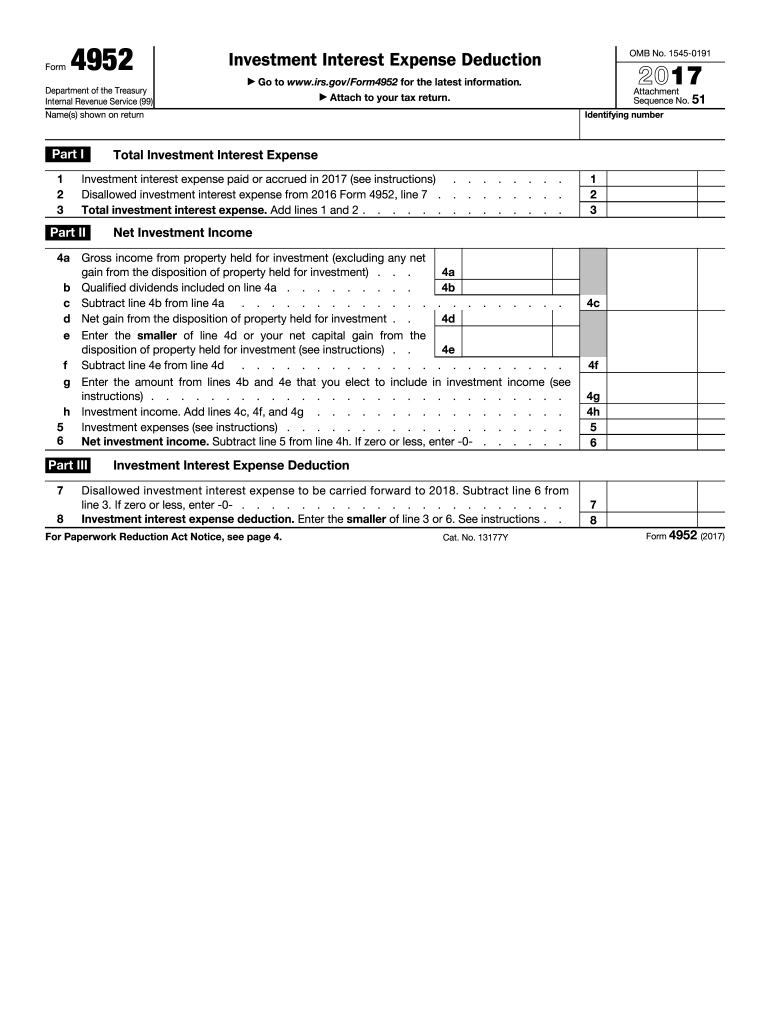

What Is Form 4952 Used For

Information about form 4952 investment interest expense deduction including recent updates related forms and instructions on how to file.

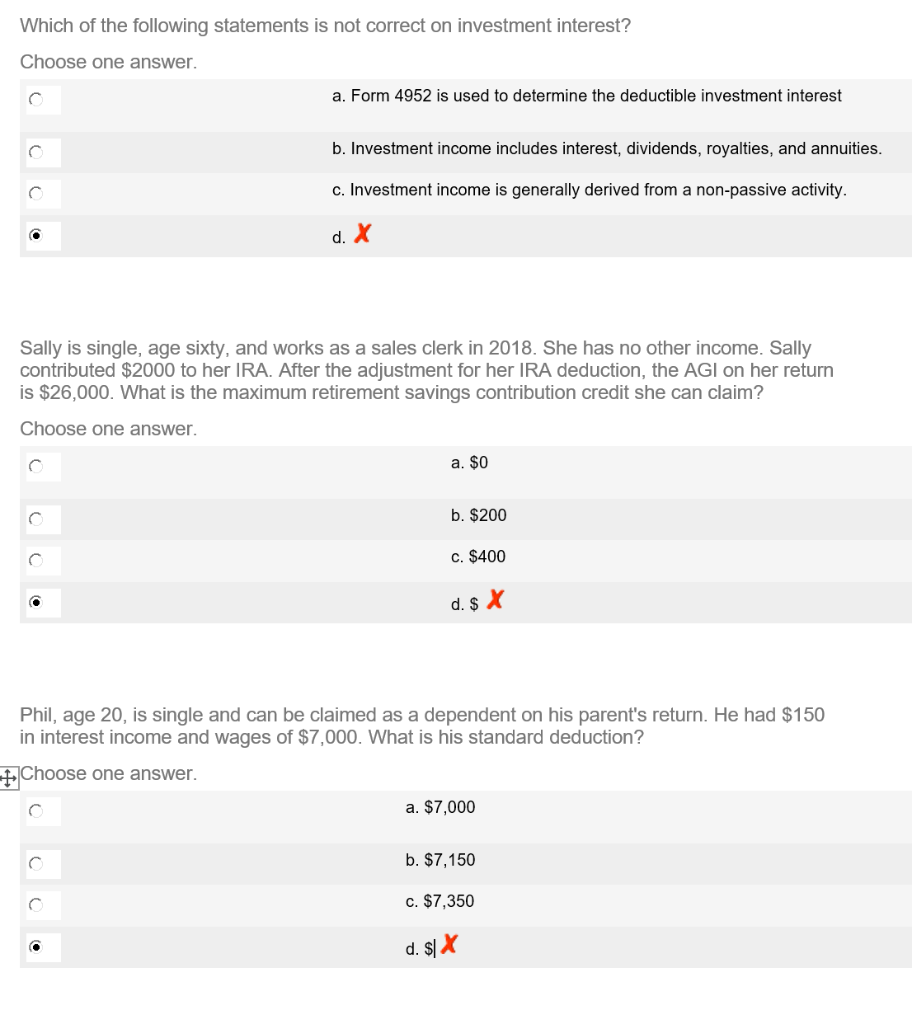

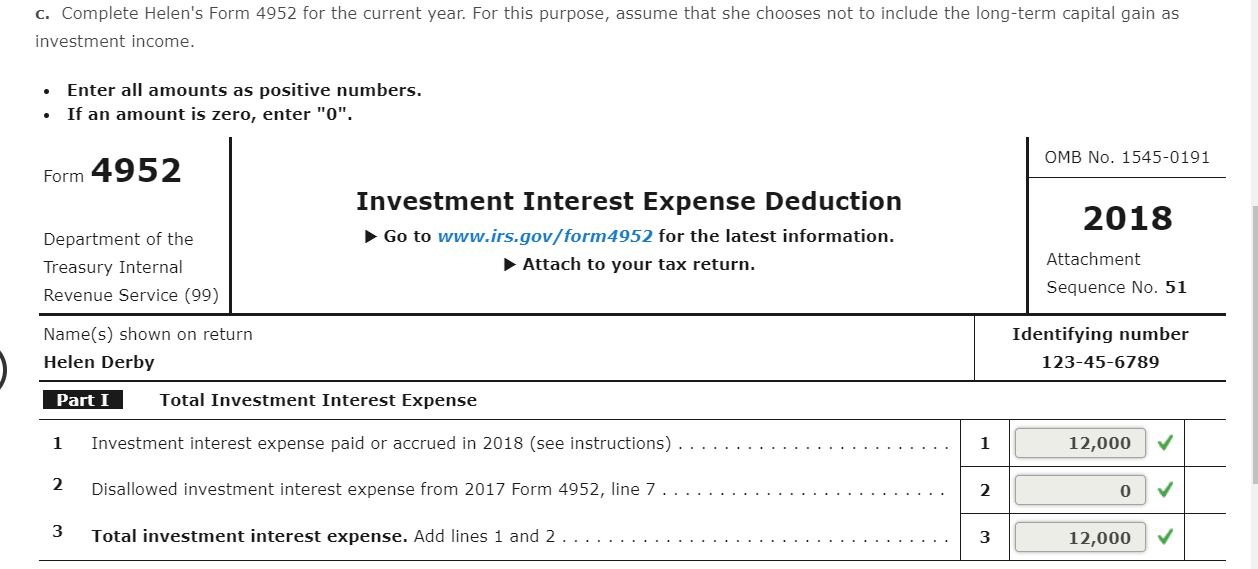

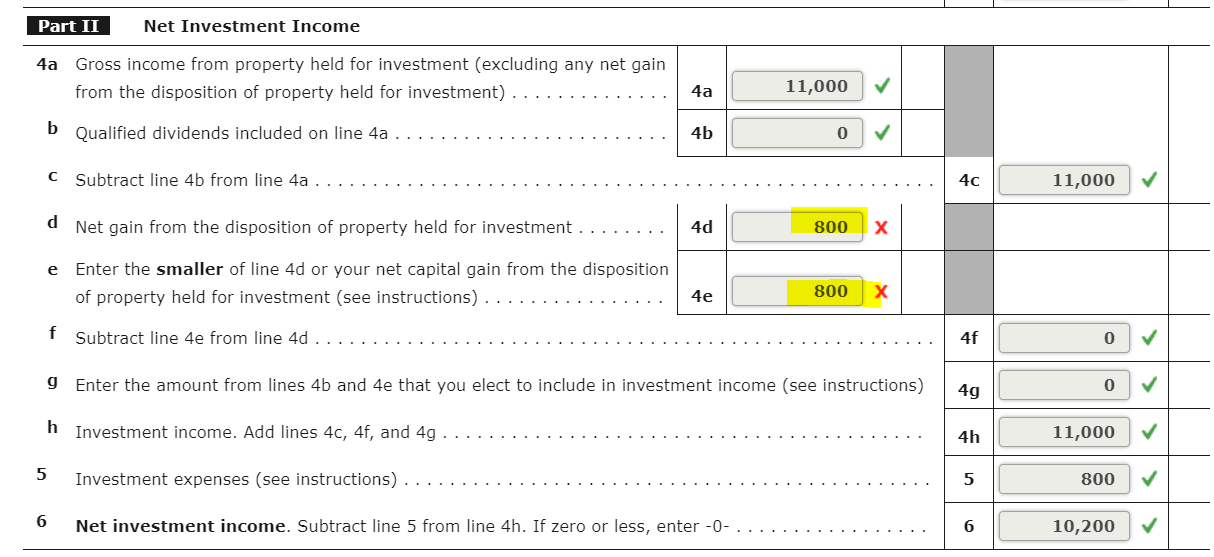

What is form 4952 used for. Where does the number come from on line 4a form 4952 line 4a gross income from property held for investment includes income unless derived in the ordinary course of a trade or business from interest ordinary dividends except alaska permanent fund dividends annuities and royalties. Specifically i cannot figure out how to calculate the amounts being requested in. Form 4952 can help you lower your tax bill. If you borrow money to purchase property you hold for investment the interest paid is investment interest.

Your investment interest expense deduction is limited to your net investment income. The amount flowing to form 4952 line 4a is 11 000. You make this choice by completing form 4952 line 4g according to its instructions. The amount flowing to form 4952 line 4a is 10 000 and the statement behind form 4952 will show a negative adjustment for the difference 1 000.

I have accumulated a large investment interest expense carryover and am at a very low tax rate after deductions i have a short term capital loss carryover and long term gains but with max 3000 capital loss on line 13. However if we enter an amount in the investment income line this will change. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Let me know if you have any question.

Brad hagen flickr if you re an investor with interest expenses rejoice you may be able to deduct them from your income using irs form 4952. The instructions for form 4952 investment interest expense deduction and form 6251 alternative minimum tax individuals instruct taxpayers on how to compute the correct taxes under both systems. I am not a cpa and a trying to find an example a completed form 4952 to try to figure it out. This election is accomplished by choosing how much of your qualified dividends and net capital gains you want to include in net investment income on line 4 g of form 4952.

The effect of this election is that qualified dividends and net capital gains included in net investment income are taxed at ordinary tax rates not at the lower long term capital gains tax rates. In line 116 investment income you have 10 000. Ultimately whichever of your form 4952s shows the higher tax is the one you will have to file with the irs.

/GettyImages-155152969-576ab8495f9b58587519065a.jpg)

/ScheduleA-ItemizedDeductions-fc8aa38a36d84f93a4fc2cbb62779cd0.png)