What Is Form 49a For Pan Card

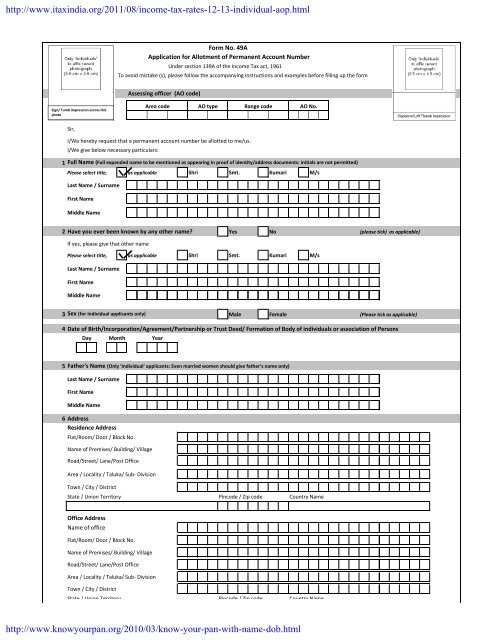

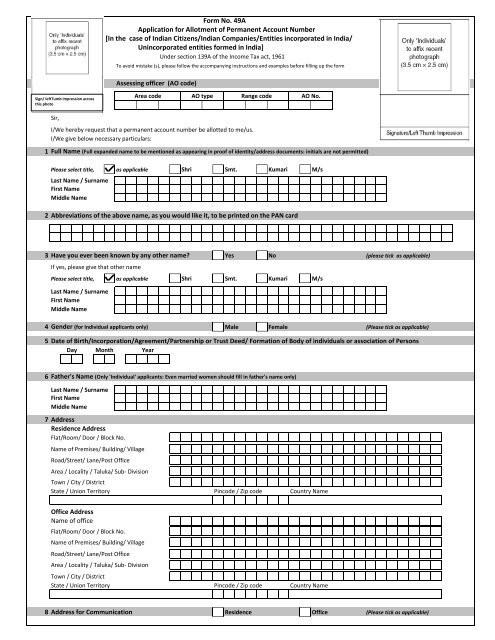

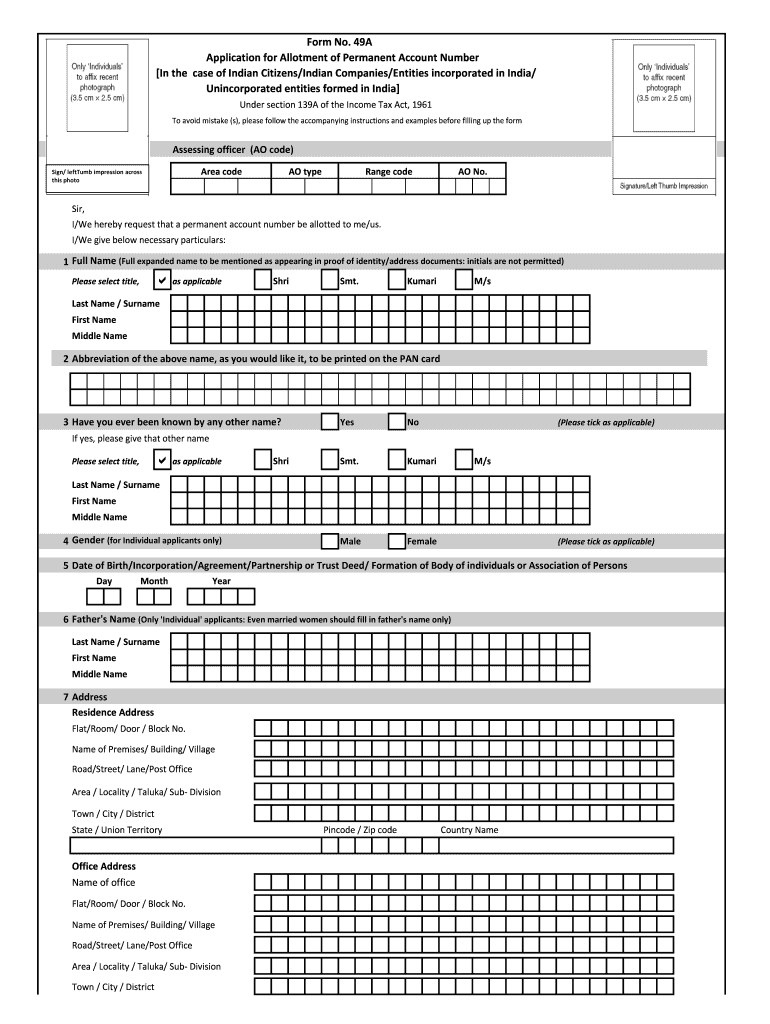

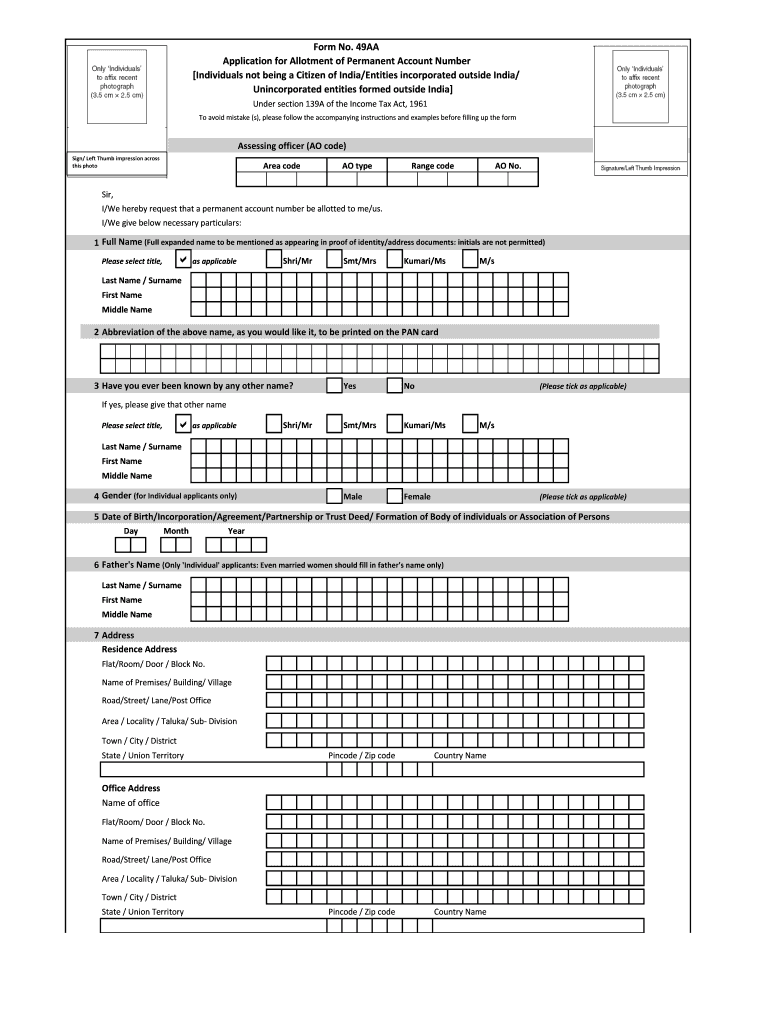

Form 49a is the application form for the allotment of permanent account number for indian residents.

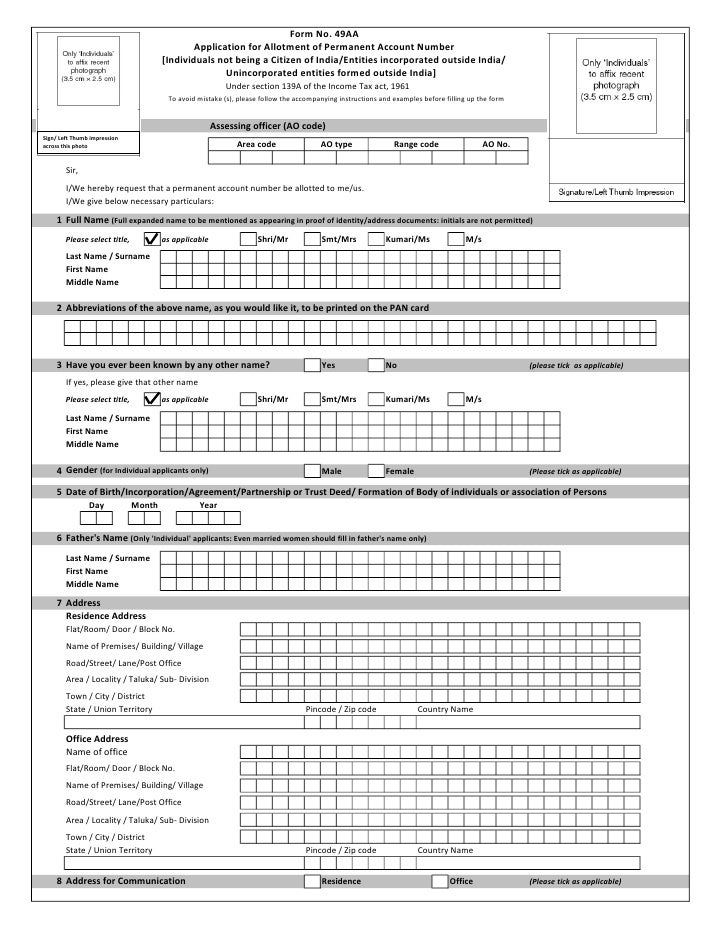

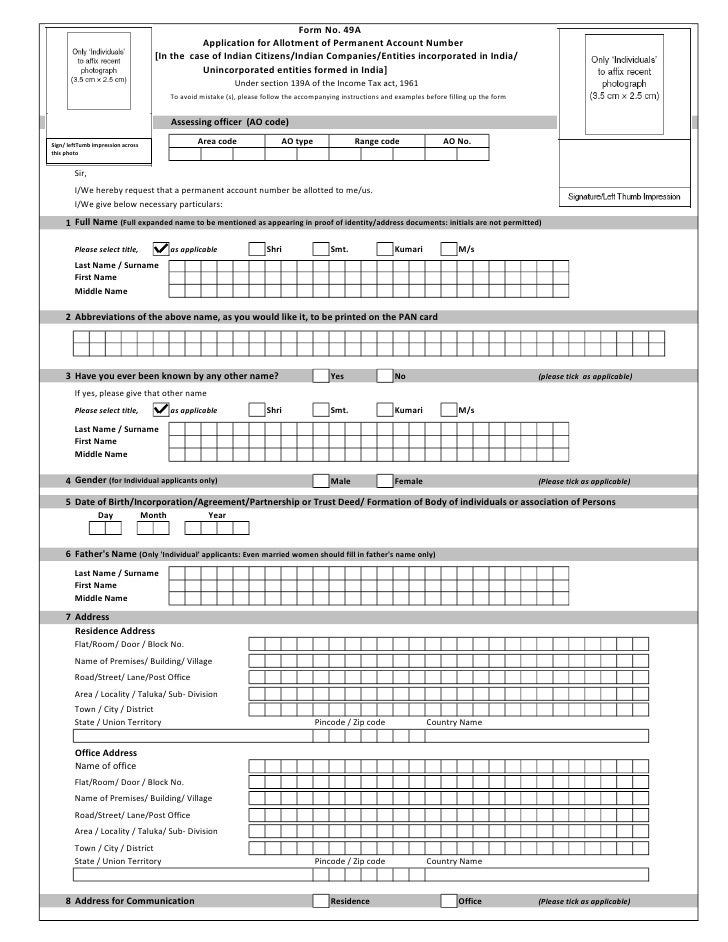

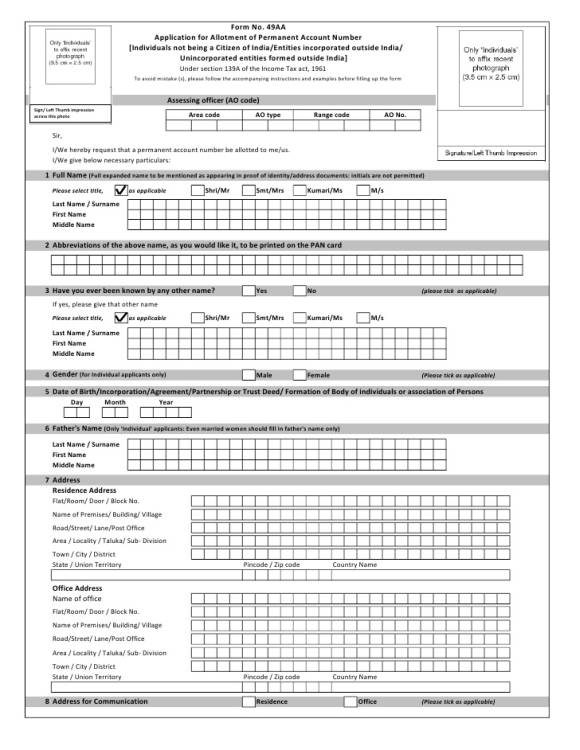

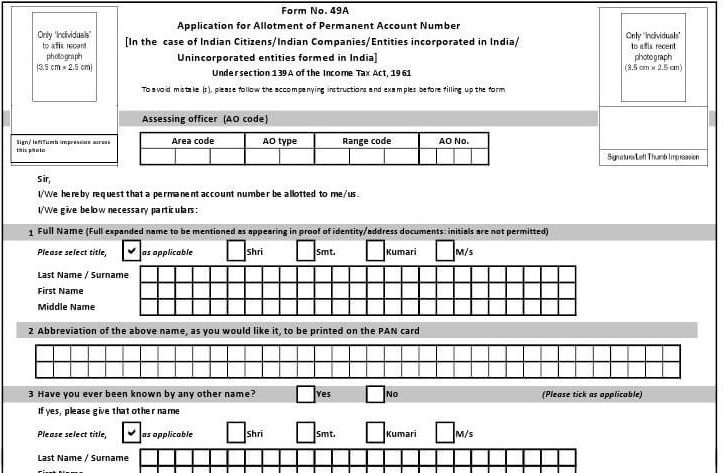

What is form 49a for pan card. However request for a new pan card with the same pan or and changes or correction in pan data can be made by filling up the form for request for new pan card or and changes or correction in pan data. The form requires to be filled in mandatorily if you wish to apply for a pan card here we will discuss the instructions that must be followed for filling form 49a. Any individual who is a resident of india and wishes to apply for pan should compulsorily fill the form 49a as it is the application form. 49a application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india under section 139a of the income tax act 1961 to avoid mistake s please follow the accompanying instructions and examples before filling up the form.

Income tax department issues pan card form 49a under section 139a of the income tax act 1961. Once the form is filled with the correct details. E applicants are required to provide their ao code details in the application. The photographs should not be stapled or clipped to the form.

49a application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india see rule 114 to avoid mistake s please follow the accompanying instructions and examples before filling up the form assessing officer ao code. This form is mandatory for obtaining the 10 digit permanent account number pan. If you want to get pan card the first thing you want to do is to fill the pan application form. Form 49a is an application for allotment of permanent account number in case of indian citizen indian companies entities incorporated in india unincorporated entities formed in india.

The clarity of image on pan card will depend on the quality and clarity of photograph affixed on the form. In case if anyone wants to apply for a pan card it is compulsory to fill form 49a first as it is the application form. Provided on the form. Learn about the structure of the form 49a documents required and rules to fill the form.

One can download the application form online from nsdl e governance official website or utiitsl website. 49a is the application for the allotment of permanent account number for indian citizens indian companies entities incorporated or unincorporated in india under section 139a of the income tax act 1961.