What Is Form 49a

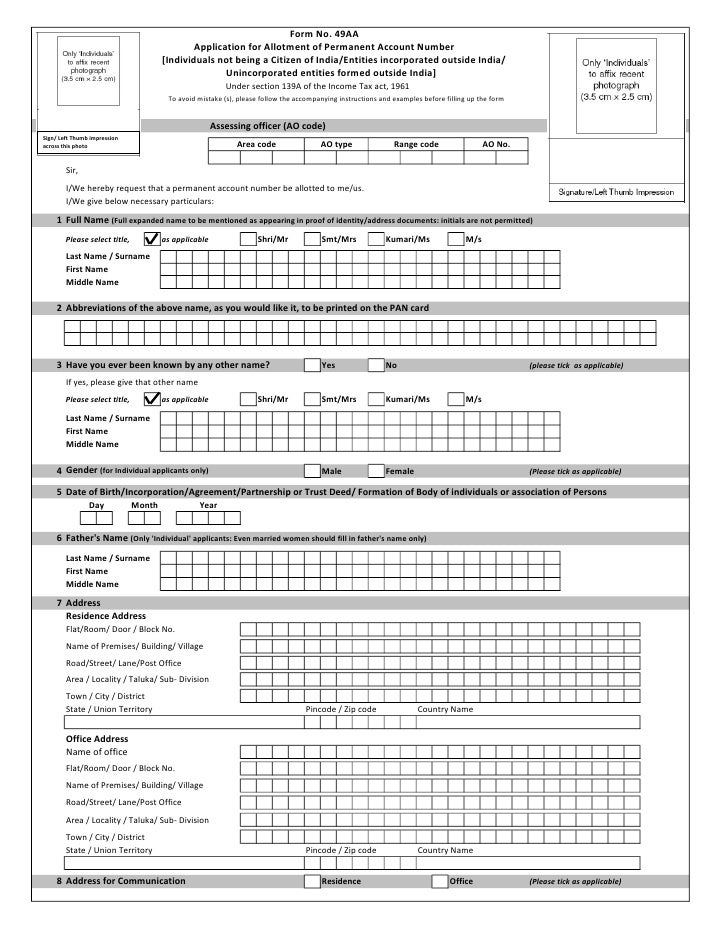

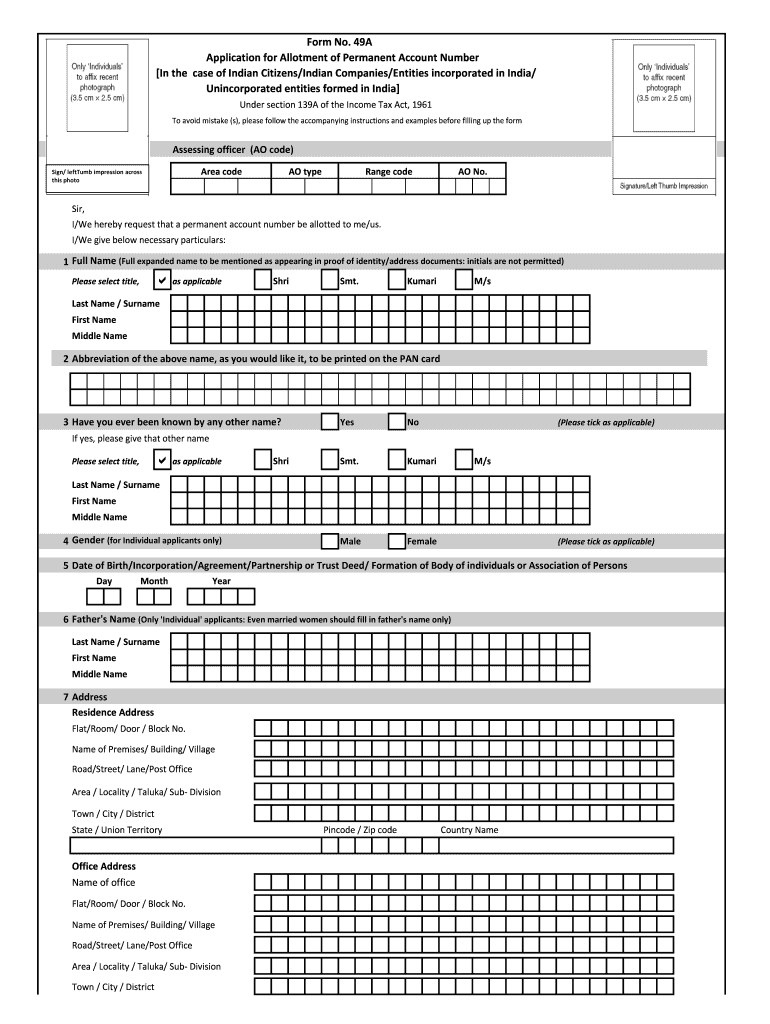

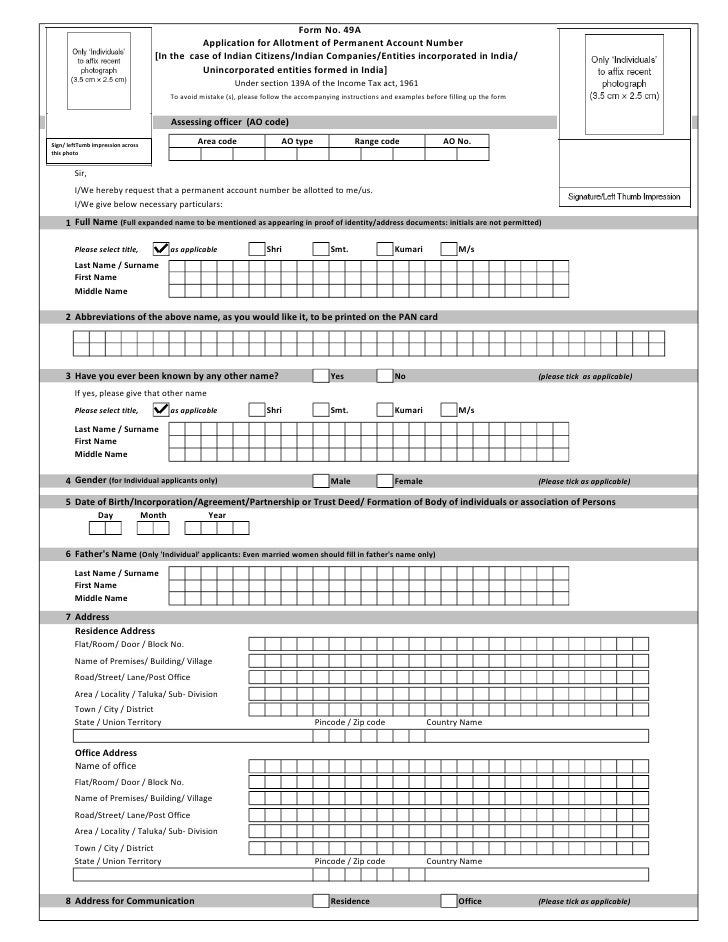

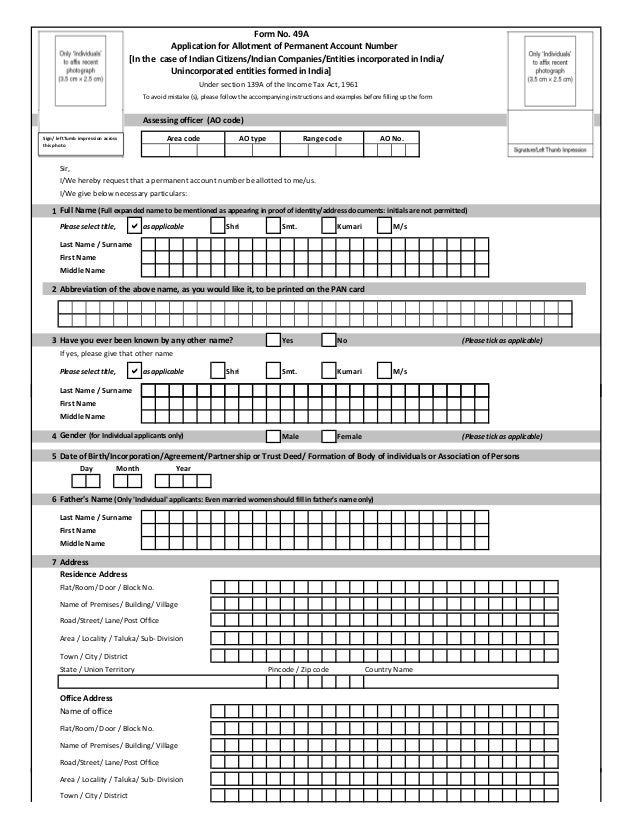

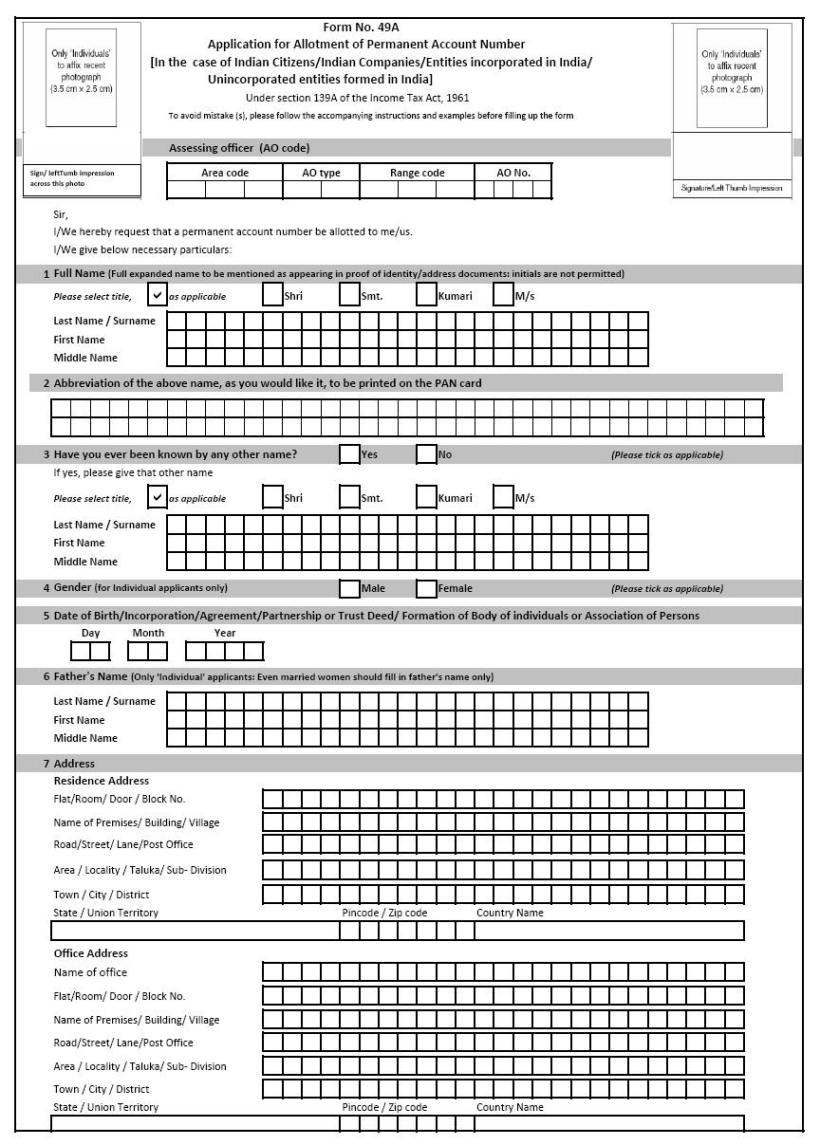

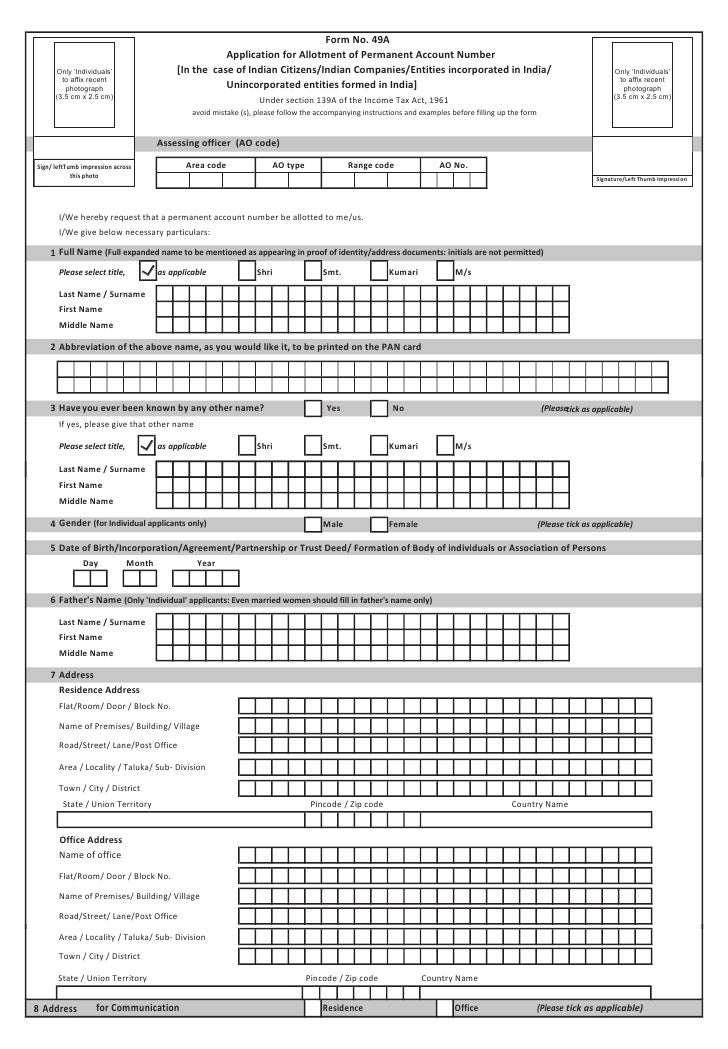

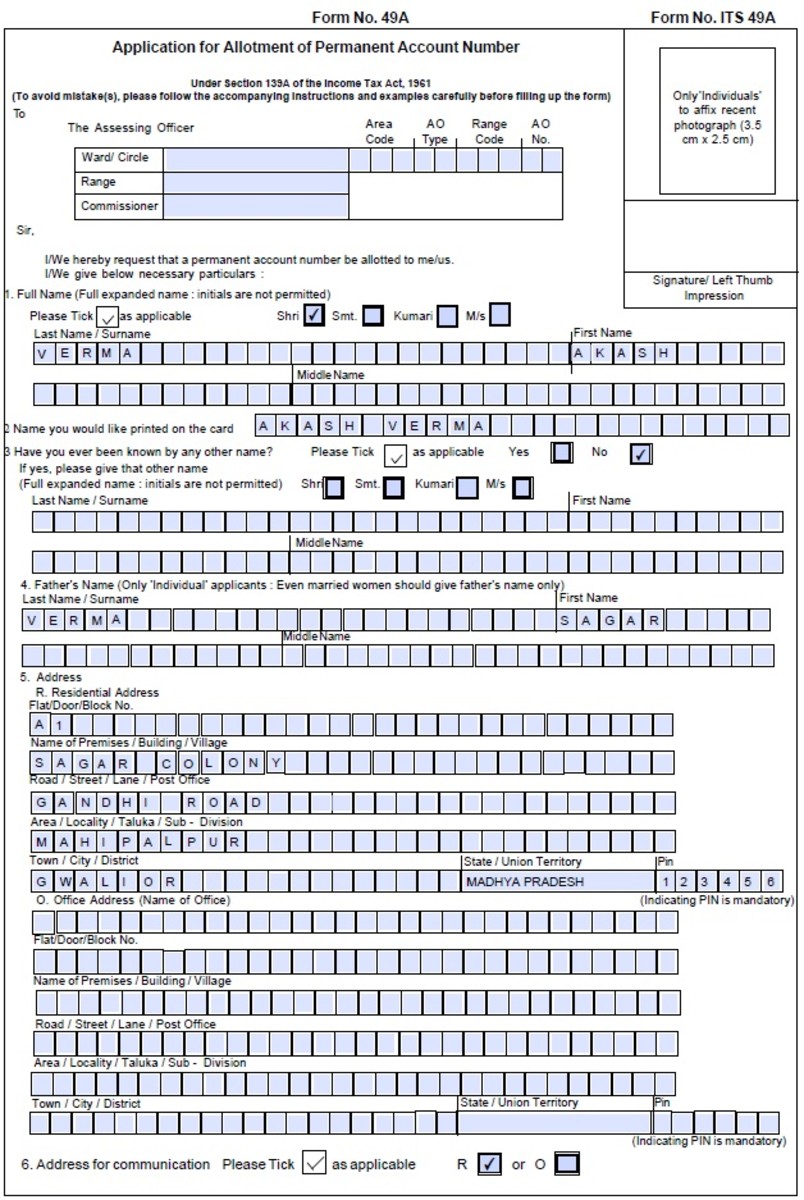

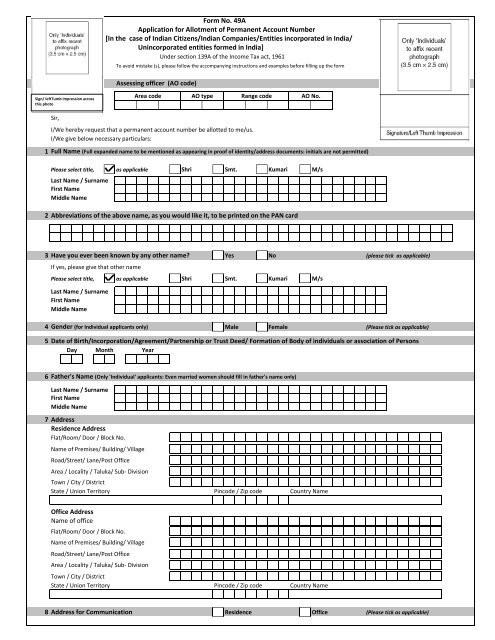

49a application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india see rule 114 to avoid mistake s please follow the accompanying instructions and examples before filling up the form.

What is form 49a. Form 49a is the application form for the allotment of permanent account number for indian residents. Form is available both offline and online. Pan form 49 a is designed for the use of indian citizens entities incorporated in india unincorporated entities formed in india and indian companies. No podb document shall be required for form 49aa.

Any individual who is a resident of india and wishes to apply for pan should compulsorily fill the form 49a as it is the application form. The form requires to be filled in mandatorily if you wish to apply for a pan card here we will discuss the instructions that must be followed for filling form 49a. Form 49a is a crucial document when it comes to allotting pan numbers so far as indian residents are concerned. Pan application form 49 a governed under nbsp.

Once the form is filled with the correct details. The poi poa and podb documents should be provided as applicable for the status of applicant mentioned in the application for form 49a. List of documents which will serve as proof of identity address and date of birth for each status of applicant is as given below. In pan card form 49a you are required to fill in your full name gender date of birth details of parents residential and office address address for communication details of parents telephone.

In case if anyone wants to apply for a pan card it is compulsory to fill form 49a first as it is the application form. Form 49a is an application for allotment of permanent account number in case of indian citizen indian companies entities incorporated in india unincorporated entities formed in india. Rule 114 of the income tax rules 1962. 49a application for allotment of permanent account number in the case of indian citizens lndian companies entities incorporated in india unincorporated entities formed in india under section 139a of the income tax act 1961 to avoid mistake s please follow the accompanying instructions and examples before filling up the form.