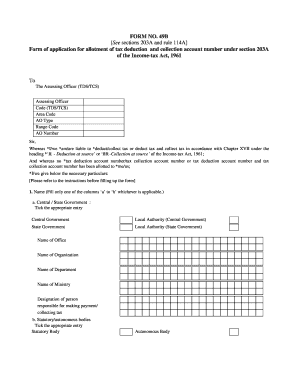

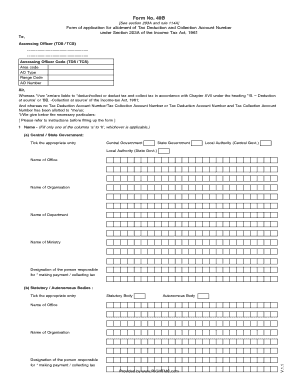

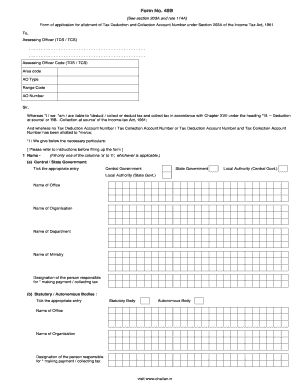

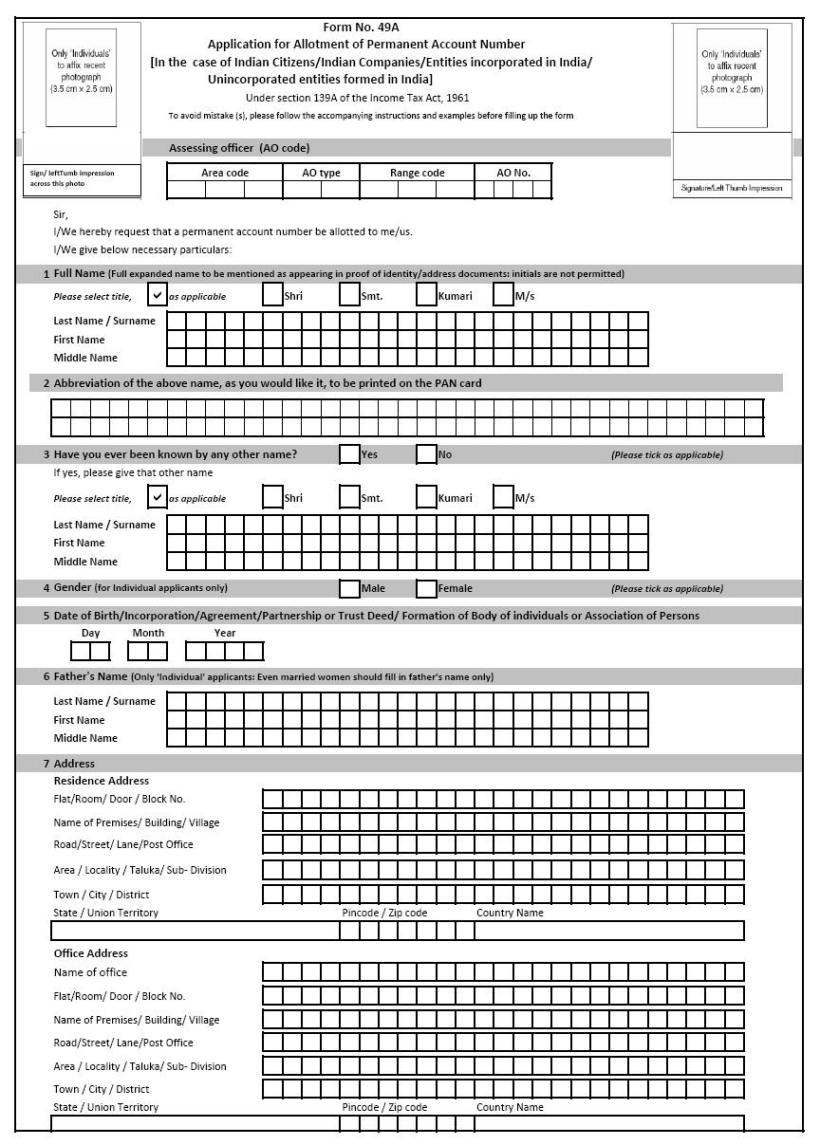

What Is Form 49b

Form 49b is a form for application for tan number or collection and deduction account number under section 203a of the income tax act 1961.

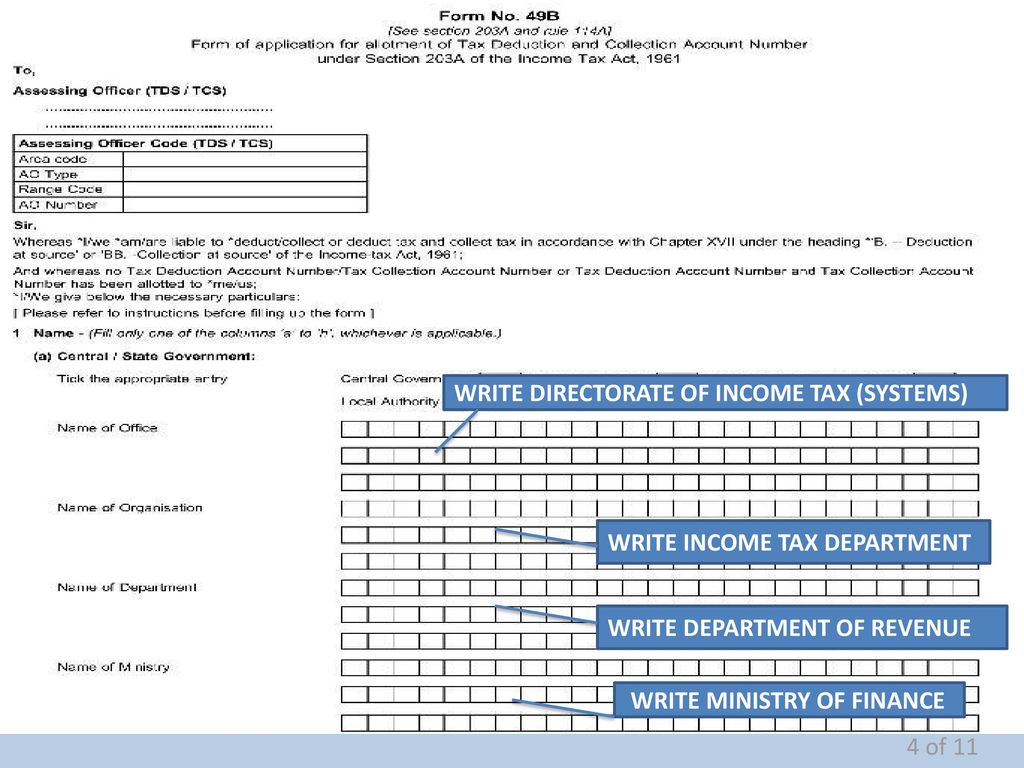

What is form 49b. Contents of form 49b. A an applicant will fill form 49b online and submit the form. Form 49b is a long application form consisting of various types of information. Know more about contents instructions for filing form 49b documents required and fee for application of tan.

Listed below are the contents of the form that need to be filled and submitted. Up form for changes for correction in tan data for tan allotted and submit the same at any tin facilitation centre. B if there are any errors rectify them and re submit the form. For all entities eligible to subtract.

C a confirmation screen with all the data filled by the applicant will be displayed. 49b see section 203a and rule 114a form of application for allotment of tax deduction and collection account number under section 203a of the income tax act 1961. Form 49b is an application form under section 203a of the income tax act 1961 for the assignment of tan number or tan deduction and payment account number. However for online application the acknowledgement received after submitting form 49b is to be saved and sent to the income tax department as proof.

The tin facilitation centre will assist the applicant to correctly fill up form 49b but incomplete or deficient application will not be accepted. Tan registration would be required for all persons required to deduct tds on transactions. This acknowledgment number can be used by the deductor collector for tracking the status of its application. D the applicant may either edit or confirm the same.