What Is Takaful Insurance

Our products and services be it for individuals or businesses assure the best quality of care and security that you need.

What is takaful insurance. Though the benefits of takaful plans are similar to conventional insurance the way takaful insurance works is very. How does it work. Read on to find out more so you have more insurance coverage options and to help you pick the best type of coverage for your lifestyle. It is a shariah compliant mutual risk transfer agreement which involves participants and operators rather than sellers and buyers.

The idea of takaful is similar to conventional insurance and shares the same fundamental roots. This is due to the apparent similarity between the contract of kafalah guarantee and that of insurance. Takaful is a system of islamic insurance based on the principle of ta awun mutual assistance and tabarru voluntary contribution where risk is shared collectively by a group of participants who by paying contributions to a common fund agree to jointly guarantee themselves against loss or damage to any one of them as defined in the pact. Takaful insurance covers various products such as life takaful motor takaful health takaful etc.

Takaful refers to a shared responsibility or joint guarantee. From medical motor takaful and home coverages to commercial cover employee benefits and many more. التكافل sometimes translated as solidarity or mutual guarantee is a co operative system of reimbursement or repayment in case of loss organized as an islamic or sharia compliant alternative to conventional insurance which takaful proponents believe contains forbidden riba usury and gharar excessive uncertainty. Takaful insurance is an islamic concept of insurance.

Takaful is a type of islamic insurance wherein members contribute money into a pool system to guarantee each other. Takaful branded insurance is based on sharia or islamic religious law and covers. Takaful malaysia provides an extensive range of protection plans to suit your diverse needs. In essence it is a shariah compliant alternative to conventional insurance.

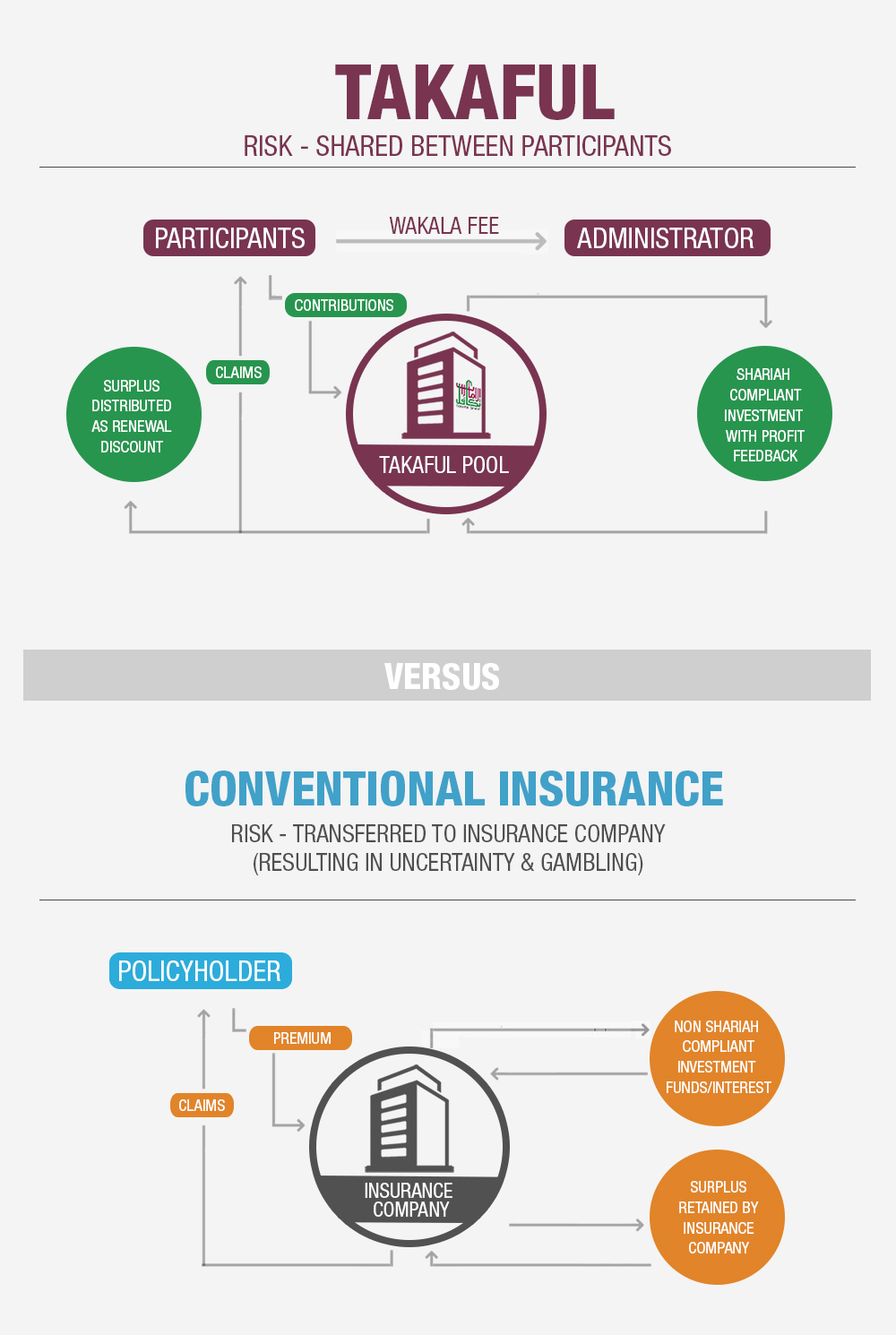

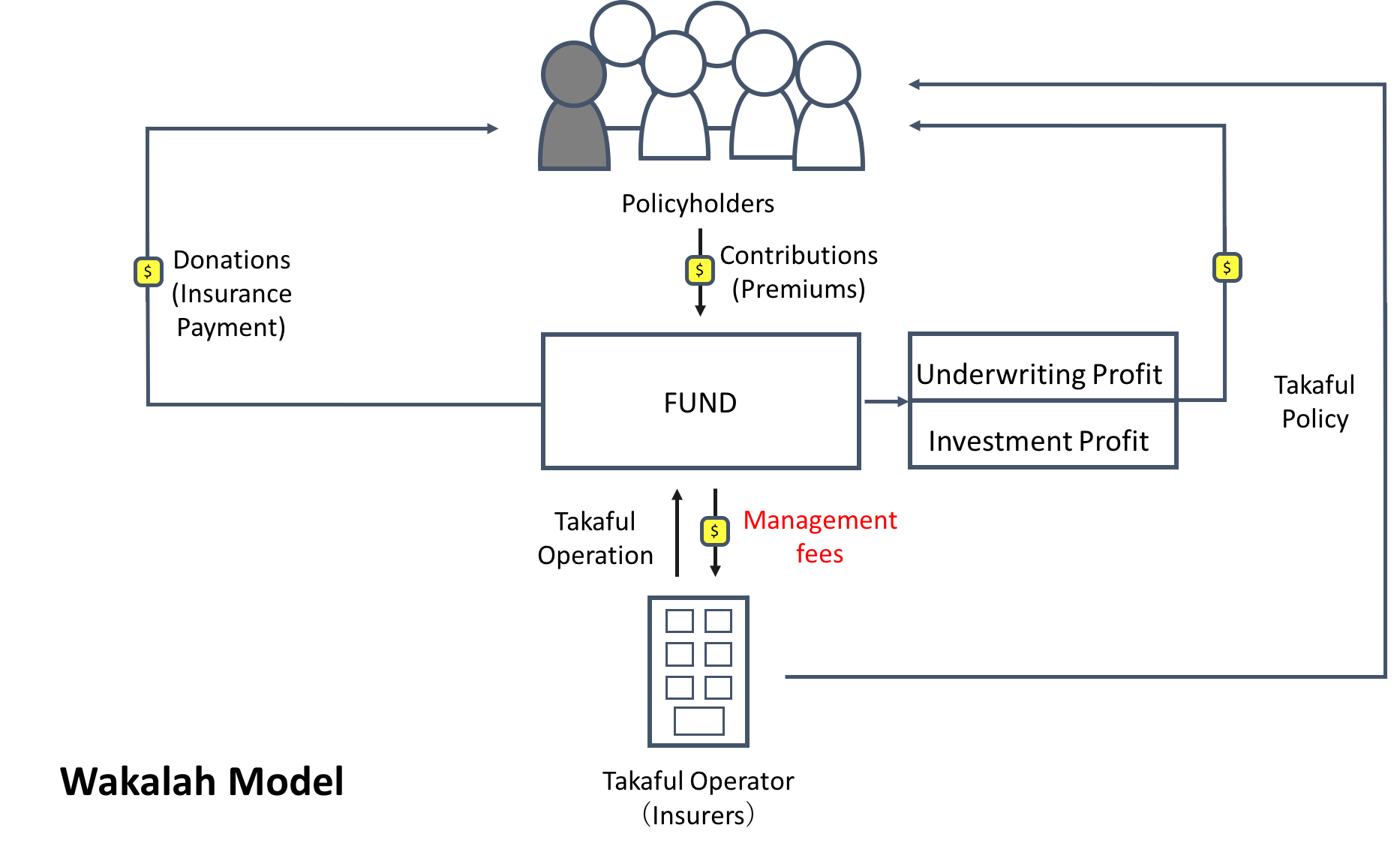

This further translates into mutual protection against losses. Takaful is fundamentally different from conventional insurance. However takaful is founded on the cooperative principle and on the principle of separation between the funds and operations of shareholders thus passing the ownership of the takaful insurance fund and operations to the policyholders. Takaful insurance as an alternative for conventional insurance takaful protects muslim from things that contravene to sharia law or against islamic principles such as riba which conventional insurance is known for practicing and charging interest meanwhile on the other hand takaful insurance is based on tabarru where a portion of the contributions made by participants is treated as a donation.

:max_bytes(150000):strip_icc()/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)